The history of financial trading

The history of financial trading is a fascinating journey that spans thousands of years, evolving from simple bartering systems to complex, technology-driven global markets. This article explores the key milestones that have shaped the landscape of financial trading as we know it today. I created this article as part of my study into the background and history of the financial markets so I could understand it better. I hope it helps you too!

Ancient Beginnings: The Barter System

Around 6000 BCE, human societies began engaging in organized trade through a barter system. This primitive form of commerce involved the direct exchange of goods and services without the use of money. For example, a farmer might trade surplus crops for tools crafted by a blacksmith. While effective for small-scale, local transactions, the barter system had limitations, particularly when it came to storing value or conducting trade over long distances.

The Dawn of Currency: Introduction of Coins

A significant leap forward occurred around 600 BCE with the introduction of standardized coinage in Lydia, located in modern-day Turkey. This innovation marked the birth of currency as we understand it, providing a more efficient medium of exchange, unit of account, and store of value. The use of coins quickly spread throughout the ancient world, facilitating trade and economic growth across civilizations.

The Birth of Stock Markets: Amsterdam Stock Exchange

The year 1602 saw a revolutionary development in financial history with the establishment of the Amsterdam Stock Exchange by the Dutch East India Company. This marked the birth of the modern stock market, allowing investors to buy and sell shares in a company. The concept of joint-stock companies and publicly traded shares opened up new possibilities for raising capital and spreading risk, fueling economic expansion and global trade.

The Rise of Organized Markets: New York Stock Exchange

Nearly two centuries later, in 1792, the foundations of the New York Stock Exchange (NYSE) were laid with the signing of the Buttonwood Agreement. This agreement, signed by 24 stockbrokers and merchants under a buttonwood tree on Wall Street, established the rules for buying and selling bonds and shares of companies. The NYSE would go on to become the world’s largest stock exchange by market capitalization, playing a crucial role in the global financial system.

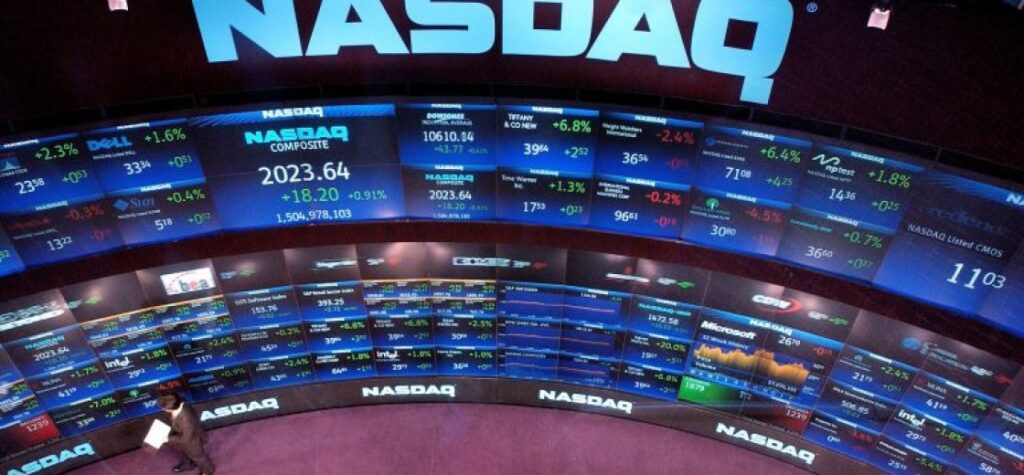

The Electronic Revolution: NASDAQ

A paradigm shift occurred in 1971 with the launch of NASDAQ (National Association of Securities Dealers Automated Quotations), the world’s first electronic stock market. This innovation marked the beginning of the end for traditional floor trading, paving the way for faster, more efficient, and more accessible financial markets. NASDAQ’s electronic trading system allowed for real-time price quotes and automated order matching, significantly reducing transaction costs and increasing market liquidity.

The Modern Era: High-Frequency Trading and Beyond

From the 2000s to the present, financial trading has undergone rapid and profound changes. The rise of high-frequency trading (HFT), powered by sophisticated algorithms and ultra-fast computer systems, has dramatically altered market dynamics. These systems can execute thousands of trades per second, exploiting minute price discrepancies across different markets. Alongside HFT, other technological advancements have shaped modern trading:

- Algorithmic trading: Complex mathematical models are used to make trading decisions, often without human intervention.

- Dark pools: Private exchanges for trading securities, not accessible to the public, have gained popularity among institutional investors.

- Blockchain and cryptocurrencies: The emergence of Bitcoin in 2009 and subsequent cryptocurrencies has created entirely new markets and trading opportunities.

Conclusion

The history of financial trading reflects humanity’s ongoing quest for more efficient ways to exchange value and allocate resources. From the simple barter systems of ancient times to today’s complex, globalized electronic markets, each innovation has built upon previous advancements. As we look to the future, it’s clear that technology will continue to play a pivotal role in shaping the landscape of financial trading, potentially bringing about changes as revolutionary as those we’ve seen in the past.

T